Insurance Unconstrained

A Complete Disruptive

Platform Solution.

Agenium, a leader in disruptive platform technology, accelerates digital innovation across the complete underwriting and new business process for Life, Health, and Annuity.

Agenium's platform vision represents a new approach to insurance, providing a cohesive and cutting-edge ecosystem that drives performance.

Leveraging dynamic rules, predictive AI, and data analytics, our clients are rapidly accelerating auto decisioning, reducing manual intervention, and increasing profitability.

Agenium solves the evolving needs of today's dynamic insurance marketplace.

Our Partners

Platform

Seamless Integration Perfects the Customer Experience

The Agenium Platform creates a technologically advanced ecosystem that streamlines processes, enhances decision-making, and offers a seamless experience for both insurance agents and applicants.

- Fully Configurable 3rd Party Integrations:

Agenium provides a user-friendly system that allows for easy configuration of data inputs. This results in efficient data integration, with rules executed based on specific conditions, minimizing unnecessary calls to third-party data sources.

- Seamless Compatibility:

Agenium's integrations are pre-built at the platform level, ensuring compatibility with any carrier, regardless of their legacy environment. This compatibility simplifies the integration process and reduces potential obstacles.

- Real-time Updates:

Agenium offers real-time updates with immediate access, guaranteeing that the information is current and readily available. This feature is particularly valuable in the insurance industry, where up-to-date data is crucial for underwriting and decision-making.

- Dynamic Risk Scoring:

Agenium's platform provides dynamic risk scoring based on underwriting rules and guidelines. This feature enables insurance professionals to assess risks more accurately, leading to informed decisions and improved underwriting processes.

Advanced Quoting & Underwriting

Agenium simplifies the quoting and underwriting process, allowing insurance professionals to access real-time quotes and assessments, resulting in quicker, more informed decisions.

Predictive Analytics

Harnessing the power of data analytics, Agenium provides predictive insights that help insurers make informed decisions about risk assessment, pricing, and customer engagement.

Customer-Centric Tools

Agenium prioritizes the customer experience by offering intuitive, user-friendly portals, self-service options for policyholders, and premium security & compliance features to enhance client engagement and satisfaction.

Solutions

A forward-looking approach to insurance, leveraging disruptive technology to reshape the industry, drive automation, and lead in data-driven decision-making.

The power of our solutions lies in their ability to harness cutting-edge technologies such as AI, machine learning, and data analytics to drive performance and enhance customer satisfaction:

Application Fulfillment

By leveraging AI and data analytics, this solution streamlines the application process, automates routine tasks, and offers personalized application experiences. It ensures faster processing, reduces errors, and tailors policies to individual needs, resulting in higher client satisfaction and improved performance.

Underwriting Workbench

With AI-driven decision support, this component enhances underwriting accuracy and efficiency. Machine learning models can analyze vast datasets to make more informed decisions, reducing the risk of errors and delays. This translates to quicker policy approvals, fairer pricing, and happier customers.

Reflexive Decision Engine

The integration of AI and machine learning in the Reflexive Decision Engine enables the creation of complex underwriting rules that adapt to evolving data and customer profiles. This dynamic decision-making process ensures that customers receive accurate assessments and optimal policy recommendations.

Integration Suite

AI-driven data analytics within the Integration Suite helps insurers tap into a wealth of external data sources. This not only improves underwriting precision but also empowers fraud detection and risk assessment. The result is more competitive pricing, lower fraud rates, and increased customer satisfaction.

Agenium leverages AI, machine learning, and data analytics to transform the insurance application and underwriting process. By enhancing efficiency, accuracy, and personalization, we drive better performance, reduced costs, and increased customer satisfaction, ultimately benefiting both insurers and policyholders.

Who we serve

Customized by You

Carriers

Streamlined operations, improved decision-making, and optimized workflows through AI-driven insights and seamless integrations.

Reinsurers

Informed risk assessment, confident portfolio management, and the ability to navigate complex risk scenarios effectively.

Distribution

Simplified insurance application and issuance processes, quicker customer interactions, and enhanced service delivery.

Insurtechs

Customizable, no-code solutions that integrate seamlessly into insurtech platforms, keeping them at the forefront of innovation and competitiveness.

Third-Party Administrators

Enhanced, fully customizable capabilities, process automation, optimization, data security & compliance, improved efficiency, cost-reduction, and superior customer service.

Business Process Outsourcing

Customizable, scalable solutions to drive automation of key tasks, improve efficiency, optimization, data-driven insights, cost-reduction and superior customer service.

Redefining Strategic Value

Agenium's vision as a New Business and Underwriting hub clearly aligns with the evolving landscape of the insurance industry - offering significant value to clients through operational efficiency, data-driven decision-making, flexibility, competitiveness, and future-readiness.

By centralizing and optimizing New Business and Underwriting processes, Agenium positions itself as a transformative force in the insurance sector.

Agenium offers open APIs that facilitate a modular approach to support legacy platforms while retaining essential features in production.

The platform supports multiple user experiences seamlessly within the same environment, ensuring versatility for all stakeholders.

Hosted on Microsoft Azure, the platform ensures state-of-the-art security, stability, and scalability, offering a robust and reliable foundation.

Agenium maintains a single code base to serve all customers, ensuring consistency and ease of maintenance.

Customer data is kept segregated by carrier, maintaining data integrity and security.

Agenium's platform stands out as the most contemporary, adaptable, and configurable no-code solution available today designed to provide efficient workflows tailored to meet the needs of various users and processes.

Our Numbers

Our numbers speak for themselves

In The News

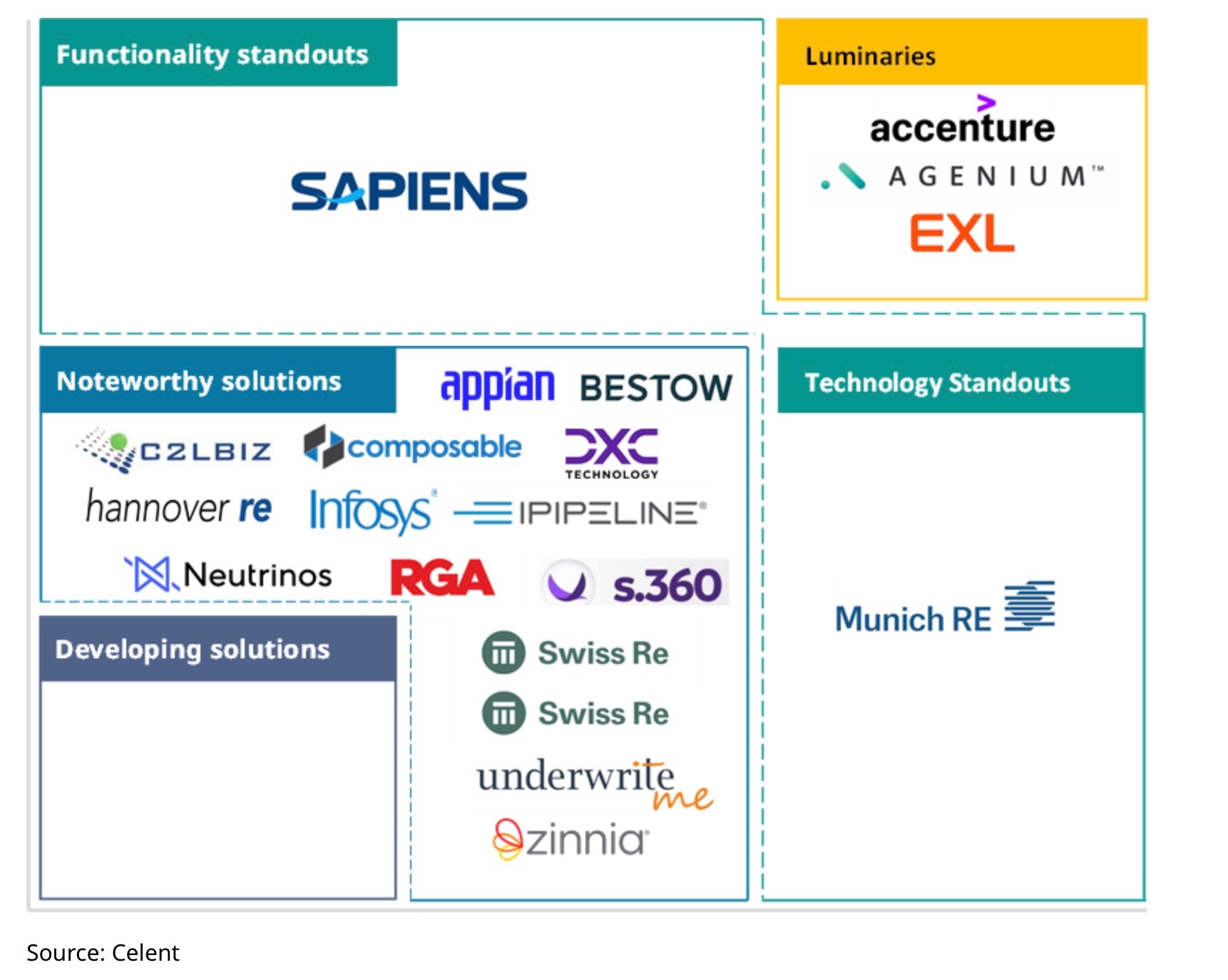

Celent Names Agenium as ‘Luminary’ for New Business and Underwriting Systems in North America

March 30, 2025

MILWAUKEE, March 30, 2025 (PR NEWSWIRE) --

Agenium, a leading New Business and Underwriting platform provider for the Life, Health, and Annuity industry, announced it has received the highest ranking of Luminary in the Celent New Business and Underwriting Systems: North America Life Insurance Edition report.

Celent reviewed 20 of the top solution providers actively providing new business and underwriting platforms in North America. Agenium was awarded two Celent XCelent awards as a top performer for both Advanced Technology and Breadth of Functionality. This distinction qualified Agenium as a “Luminary” – the highest category for market leaders that excel in New Business & Underwriting Systems capabilities.

“Agenium offers a modern, SaaS based new business and underwriting platform. Its no-code configurability, support for headless applications, and an underwriting / case management workbench provides new business capabilities to over 30 clients today,” states Karen Monks, Principal Analyst in Celent’s Life Insurance Practice and co-author of the recent report. “Agenium’s recent investments in their platform bodes well for their future as insurers expand their use of new business platforms for more products.”

“As more underwriting decisions are being made closer to the point-of-sale, carriers and reinsurers are looking to modernize their core new business and underwriting processes with platforms that support rapid development of new digital processes and utilization of important 3rd party data”, explained Michael Risley, Agenium’s CEO.

Agenium offers a technologically advanced, fully integrated platform, including an underwriting decision engine and workflow tools, that can dramatically reduce speed-to-market for new products. The platform uses pre-built integrations to all the data providers and automates most all the manual efforts to get cases in good order and issued. The resulting ecosystem streamlines processes, enhances decision-making, and offers a seamless experience for insurance agents, applicants, carriers, and reinsurers.

To learn and see more about the report and why Agenium, visit here. For more information on Agenium’s New Business and Underwriting solutions, click here.

Contact Us

If you have any questions, please feel free to contact us via email.

Get in touch

Contact us via email

Location:

250 East Wisconsin Ave

18th Floor

Milwaukee, WI 53202

Email:

sales@agenium.ai